Executive Summary

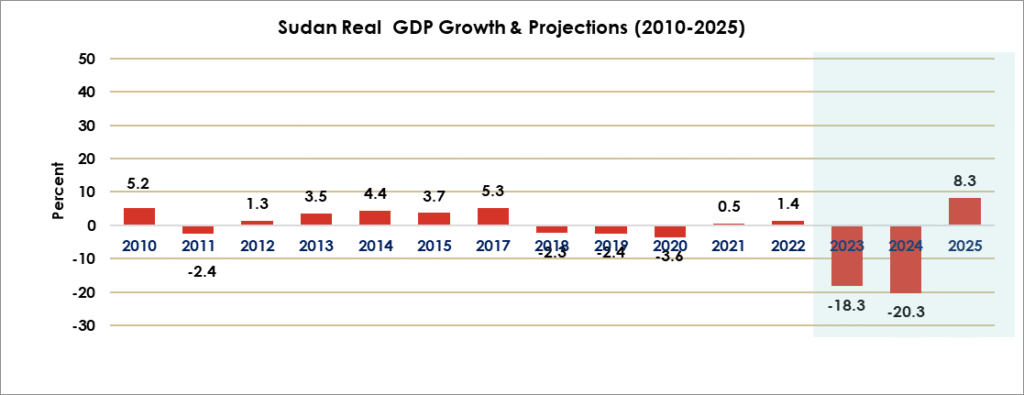

The conflict that erupted in Sudan on April 15, 2023, has caused a devastating humanitarian crisis and severe economic fallout. Essential goods have become unaffordable for many, with prices surging due to supply shortages, driving inflation to triple-digit levels. The Sudanese pound has sharply devalued against the U.S. dollar, while real economic growth contracted by 20.3 percent in 2024—the largest contraction in Sudan’s history, due to the destruction of the country’s production capacity and disruption of economic activities.

This unprecedented decline is largely attributed to the devastating toll of the ongoing armed conflict, which has crippled the nation’s production capacity and disrupted key economic activities. On the supply side, the destruction of infrastructure and a sharp decline in services have dragged down growth. On the demand side, widespread displacement and loss of income have severely weakened consumption, further exacerbating the economic downturn.

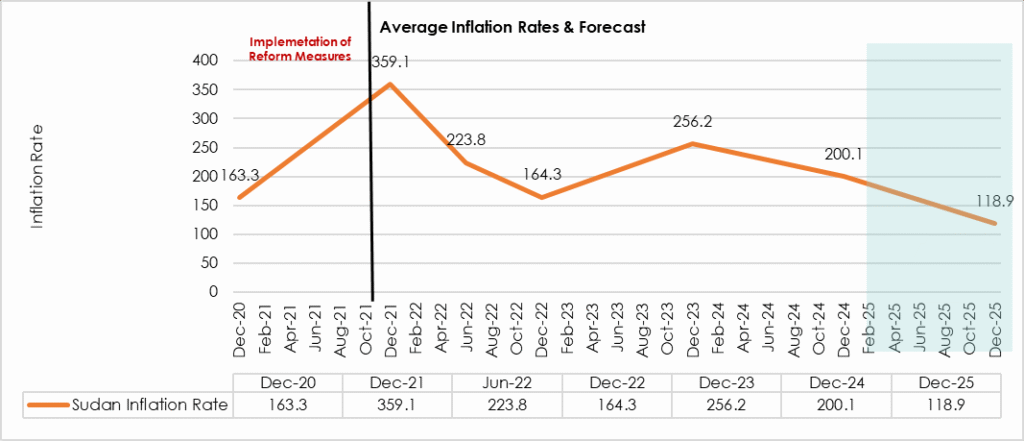

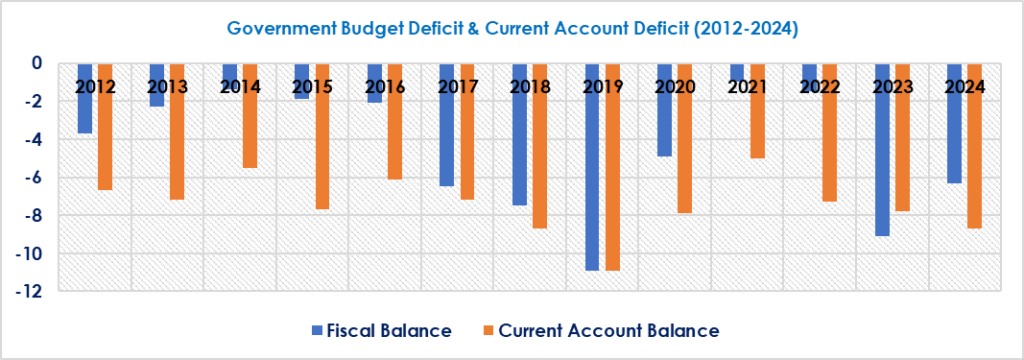

Sudan’s monetary, exchange rate, and fiscal policy reforms, initiated under the 2019 Transitional Government, have stalled, with many of the gains made before the current conflict now reversed. CPI inflation remained in triple digits at 200.1 percent. The twin deficits—fiscal and current account—reached unsustainable levels of 6.3 percent and 8.7 percent, respectively, in 2024, further exacerbating the economic crisis. This paper also presents projections for 2025. However, it is important to note that these projections are subject to significant uncertainties, primarily dependent on the cessation of conflict and the successful implementation of economic reforms.

The war has inflicted over $180 billion in damages, leaving Sudan’s economy severely depressed. Recovery and rehabilitation require urgent international cooperation, financial aid, and a clear roadmap to rebuild infrastructure, restore basic services, and support displaced populations. Ending the war and implementing strategic reforms are critical to stabilizing the economy, addressing humanitarian needs, and reintegrating Sudan into the international community.

The paper emphasizes the importance of leveraging digital technologies, such as mobile money, to deliver aid efficiently. It advocates for a new social contract grounded in good governance, transparency, and equal opportunities for all Sudanese citizens. Priorities include reforming state-owned enterprises (SOEs) to mitigate fiscal risks, enhancing governance of natural resources to combat illicit trade, and fostering private sector growth.

Economic recovery and political stability are interlinked, requiring civilian control over the economy and comprehensive reforms. The path to rebuilding Sudan lies in fostering inclusive development, sustainable growth, and a peaceful, democratic transition that benefits all Sudanese people.

Path Forward: Key Policy Recommendations

- Comprehensive Reforms: Address the deepening economic contraction by prioritizing macroeconomic stability, governance improvements, and human capital development.

- Inclusive Development: Focus on rebuilding Sudan’s economic foundation with sustainable growth strategies that ensure equitable benefits for all citizens.

- Natural Resource Management: Combat illicit gold trade and financial flows that undermine Sudan’s democratic transition by strengthening governance in natural resource management.

- Financing Access: Unlock financing through banking sector reforms, debt restructuring, and comprehensive economic strategies.

- Targeted Investments: Facilitate recovery by rebuilding critical infrastructure, restoring essential services, and strengthening social safety nets.

Introduction

The war that erupted on April 15th, 2023, in Sudan has triggered a costly humanitarian crisis that urgently requires a peaceful resolution. Simultaneously, the economic fallout from the conflict is poised to lead to an unprecedented slowdown in Sudan's history. Prices for essential goods have surged, disproportionately impacting vulnerable populations. Moreover, the price hikes caused by the war and the widening pressures on prices due to scarcity and supply shortages are expected to translate into inflationary pressures.

Sudan is at a dangerous crossroads. The economy remains severely depressed. It is going to be a tough economic condition in 2023 and possibly even tougher in 2024 with increased costs associated with the war. The business sector downturn, reduced household purchasing power, and international isolation are expected to drive real economic growth into (ve) territory, of 20.3 percent in 2024. The SDG’s value against USD has halved since the beginning of 2024, and further devaluation is expected if the conflict persists in 2025, while CPI inflation is expected to be in the triple digits, and twin deficits may surpass sustainable limits.

Sudan's primary challenge at present is ending the war, as it continues to incur substantial economic losses. Once both parties agree to a ceasefire, the implementation of a strategic reform plan could help restore economic stability and support rehabilitation initiatives. Amidst the ongoing six-month-long conflict in Sudan and the resulting humanitarian crisis affecting internally displaced Sudanese citizens and refugees, the delay in ending the war only exacerbates these losses. It is worth noting that the ongoing war has inflicted damage and economic losses exceeding $180 billion so far. With this unprecedented level of devastation, the process of rehabilitation will require substantial financial resources. However, Sudan cannot bear this burden alone; it necessitates assistance from development partners and allies to facilitate its path to recovery.

In the same vein, international cooperation holds significant importance for Sudan. The process of Sudan’s reintegration into the international community plays a vital role in ensuring political stability and security within the country. Though international cooperation facilitates the establishment of diplomatic relations, encourages peace negotiations, and aids in resolving conflict, all of which contribute significantly to Sudan's overall stability and security. Moreover, it is of utmost importance to extend support to Sudan's rehabilitation endeavors, which encompass essential tasks like infrastructure reconstruction, restoration of basic services, providing humanitarian aid to the most affected communities, and attracting foreign investment and financial assistance to achieve inclusive and sustainable development. The goal is to ensure that no one in Sudan is left behind and that all Sudanese citizens benefit from these endeavors.

The policy brief concludes that Sudan needs a roadmap to help its people bounce back, particularly by leveraging digital technologies. One key strategy is promoting the use of mobile money to deliver aid for the neediest.

In the post-war era, it is crucial to establish a new social contract for all Sudanese, ensuring equal opportunities for everyone. This approach is fundamental to building a civil rule rooted in good governance and transparency. Such a framework prioritizes economic stability, peaceful coexistence, and the equitable distribution of resources for all Sudanese citizens.

The policy brief recommends focusing on civil government financial sovereignty. Civilian control of the economy is essential for a democratic Sudan. Attention to reforming state-owned enterprises (SOEs), including governance improvements, is necessary. This reform would help mitigate fiscal risks and create a more enabling environment for private sector-led growth.

By the same token, enhancing the political economy and management of natural resources is crucial. This need becomes even more crucial given the substantial influence of illicit gold trade and financial flows on Sudan's democratic transition. Effectively addressing these challenges is an urgent necessity.

Safeguarding economic stability requires assessing the implications of the ramifications of war. This assessment correctly emphasizes the detrimental effects of escalating conflict on Sudan's future economic trajectory. Against this backdrop, this report outlines recent economic developments during the war and provides an outlook for the future.

Recent Macroeconomic Developments and Outlook

- Real Sector

- Real GDP Growth

The real GDP is expected to shrink by 20.3 percent in 2024. To clarify, the estimated total productive infrastructure and capital stock[1] for Sudan, amounts to $600 billion (this is not Sudan’s GDP); its calculations are different. If we consider that we have already lost approximately 30 percent of this stock, our losses amount to $180 billion. In 2022, agriculture contributed 32.7 percent to the GDP, while manufacturing contributed 21 percent. However, this year, the total farming area has significantly reduced, possibly by as much as 50 percent.

Agriculture, which accounted for 32.7 percent of the GDP in 2022 and employs more than 70 percent of the population, is expected to contract due to insufficient funding, the absence of government backing, and security issues (less farming). Consequently, this situation risks both food security and employment prospects. Nevertheless, the states that remain safe present a chance to prioritize agribusiness as a key sector to enhance food security, reduce poverty, and enhance living conditions.

Moreover, we have witnessed the destruction of more than 50 percent of factories and 70 percent of food industries. Khartoum state (before the war) contributed around 25 percent to the GDP. Importantly, the manufacturing sector's contribution to the GDP was 21 percent in 2023, and it is expected to decline by more than half this year.

Sudan’s real GDP grew by 0.6 percent in 2022. This growth can be attributed to improved performance in the agricultural and manufacturing sectors. However, given these circumstances of rising risks of ongoing conflict, our forecast predicts a decline in GDP of approximately 20.3 percent (Chart 1. If the war ends, a recovery of 8.3 percent is expected in 2025. It's important to note that these projections are subject to significant uncertainties, primarily hinging on the cessation of conflict and the successful implementation of economic reforms.

Chart 1: Real Gross Domestic Product (GDP) Growth During (2010- 2025)

Source: Central Bureau of Statistics & IMF

- CPI Inflation

Inflation: Prices on the Rise: In Feb 2023, the inflation rate dropped to 63.3 percent from 83 percent in the previous month. Yes, due to the ongoing war, the government couldn’t reveal the current inflation, sparking concerns of a notable price surge.

By the same token, Sudan’s average annual inflation rate recorded 256.6 percent in 2023, marking a considerable rise from 164.3 percent in 2022. However, these projections drastically shifted following the war. In August 2021, inflation declined by 35 points for the first time in more than a year and decelerated in the following months in response to fiscal consolidation efforts (Chart 2). CPI inflation declined to 200.1 percent in 2024 and is projected to further decline to 118.9 percent in 2025. It's important to note that these projections are subject to significant uncertainties, primarily hinging on the cessation of conflict and the successful implementation of economic reforms.

Chart 2: Average Inflation Rates During (Dec 2020- Dec 2025)

Sources: Central Bureau of Statistics & IMF & CBOS Projections

- Public Finance

Sudan's fiscal landscape has been significantly impacted by ongoing conflicts and economic challenges in recent years. Here's an overview of the budget deficit trends for 2022, 2023, and projections for 2024.

Several challenges have impeded Sudan's efforts to achieve its revenue mobilization goals. These include substantial revenue losses due to widespread tax exemptions and tax breaks in VAT, customs, and corporate tax. Weaknesses in the customs and tax administration have also contributed to the issue. Corruption in the management of tax exemptions, especially for specific imports and exports, has further hindered Sudan's tax collection capability. The Tax Chamber has faced criticism for inconsistent and non-transparent enforcement of tax regulations, allowing politically connected companies to evade taxes.

Sudan's tax revenue performance has averaged 6-7 percent of GDP between 2016 and 2022, significantly lower than the 16.5 percent average in other Sub-Saharan African (SSA) nations. The situation during the ongoing war is even more dire. The Ministry of Finance& Economic Planning (MOFEP) is currently unable to generate enough revenue to cover wages, salaries, and provide social protection to the most vulnerable. The MOFEP initially estimated its total revenues, including foreign grants, to be SDG 7.3 trillion in 2023, compared to SDG 3 billion in 2022. This projection appears irrational, even in the absence of war, as they could collect revenues at a rate of 12.4 percent per year. With the precarious war situation, we anticipate significant revenue shortfalls for 2023. Unfortunately, to date, there has been no report from the MOFEP regarding the general budget performance.

In 2023, MOFEP faces significant challenges due to an 87 percent increase in employee compensation (rising from SDG 1.1 trillion in 2022 to SDG 2.1 trillion in 2023), potentially necessitating temporary advances from CBOS due to wartime conditions. Indirect taxes contribute over 85 percent of tax revenue, while direct taxes like PIT make up only 15 percent. Business closures and worker wage and salary suspensions, and worker layoffs further complicate tax collections and mobilization for domestic revenue.

The combined workforce in both the public (including the military sector) and private sectors is approximately 10 percent of the total population. Currently, there are about one million public sector workers who are not receiving salaries, whereas the military sector has received its payments. Given this scenario, it becomes crucial to help public sector employees recover and bounce back.

In terms of funding the war effort, the MOFEP is currently grappling with significant challenges in availing physical space in the budget for funding the Sudanese Armed Forces (SAF) against the Rapid Support Forces (RSF) paramilitary. It is important to note that the 2023 Government State’s General Budget, issued in January 2023, highlighted challenges faced in implementing the 2022 state’s budget. These challenges included weak tax collection, low domestic revenue mobilization, and increased expenditures on security and defense. The implementation challenge for the 2023 budget has become even more daunting, as the war broke out in the second quarter of the same year, exacerbating the fiscal situation.

In this precarious scenario, MOFEP has prioritized payments to SAF and other security forces, as well as allocations for fuels, procurement of goods and services, and items related to the war effort. However, with war, there is no sign of improvement in revenues as a result of the closure of business activity and also international isolation, which has impacted the flow of grants to the government.

Regarding the State's Budget deficit, Chart 3 illustrates that the 2021 budget performed better than the previous three years (2018-2020). This improvement is attributed to fiscal consolidation efforts, a clear reform roadmap in the SMP and ECF, and strict adherence to specified limits for temporary advances from CBOS in 2021. Consequently, the fiscal balance was enhanced, reaching 1.0 percent of GDP in 2021. The current account deficit (cash basis) was maintained at a sustainable limit of 5.0 percent of GDP in 2021. However, in 2022, the external position deteriorated due to the suspension of reform programs, particularly financial assistance. Under the wartime scenario, our estimations align with the IMF and African Development Bank (AfDB) projections, indicating a further deterioration in twin deficits (budget deficit and current account deficit) in 2024 and 2025.

The fiscal deficit widened substantially to 9.1 percent of GDP in 2023. This increase was attributed to a significant drop in government revenues amid ongoing armed conflict, which severely disrupted economic activities and diminished the tax base. The conflict led to a contraction in the current account balance to GDP by 8.6 percent due to the destruction of production capacity and the displacement of populations.

While projections for 2024 indicate a potential narrowing of the fiscal deficit to 6.3 percent of GDP, contingent upon the restoration of peace and subsequent economic recovery efforts. This anticipated improvement assumes that increased government revenues from reconstruction activities will help moderate inflation and stabilize the economy.

Chart 3: Sudan’s Twin Deficits Phenomenon (2012-2024)

Source: Government State’s Budget (MOFEP), Sudan Article IV Consultation Reports, IMF

- External Sector

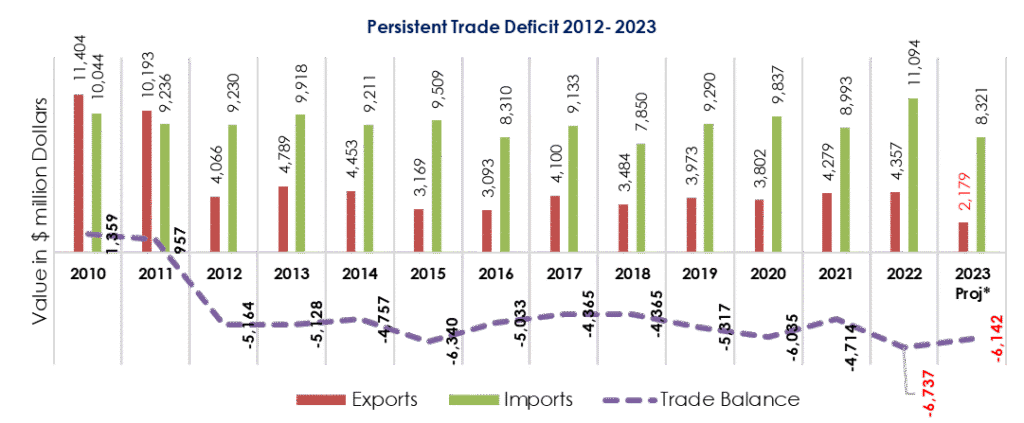

Export activity update. Despite the ongoing war, there has been a noticeable level of export activity, with over 5,000 export certificates issued recently, along with imports. Considering the changing landscape, influenced by political dynamics, we anticipate a continued devaluation of the SDG. Although the exchange rate has remained relatively stable for a while, there was a significant drop of around 30 percent in the SDG's value last week.

Recent data from the National Chamber of Commerce reveals that the export volume from May 17 to July 17, 2023, amounted to $65.7 million. Among these exports, Sudanese groundnuts accounted for $22 million, cotton for $15.4 million, and sesame for approximately $12 million. This weak performance clearly illustrates the adverse effects of the ongoing war. It's important to highlight that the monthly average of exports in the previous year, 2022, reached $363 million, which is five times higher than the volume recorded for May to July 2023.

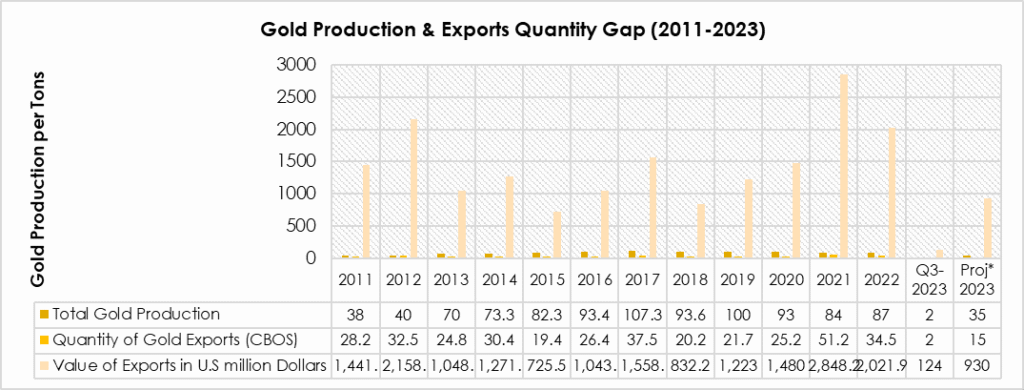

The paradox of rich resources and a weak economy. Gold Exports witnessed a significant drop following the war, whereas in the previous year, 2022, gold exports accounted for roughly 50 percent of total exports. According to the CBOS foreign trade statistical digest, the trade deficit reached $6.7 billion, with exports at $4.3 billion and imports at $11.7 billion in 2022. Exports are expected to decline by more than 50 percent due to various challenges related to gold production by artisanal miners, who contribute to 85 percent of gold production. These challenges include security issues, a lack of markets, difficulties in transportation and movement, and a shortage of materials for gold purification, such as Mercury and cyanide (which will be imported by government-owned companies). It is worth noting that illicit gold and illicit financial flows are key drivers for undermining Sudan’s democratic transition!

Regarding the export of gold during wartime, the latest press release from Sudan Mineral Resources Company (SMRC) on September 14 stated that concession companies produced and exported two tons of gold from April 15 to August 31, 2023, with a total value of proceeds amounting to $124 million (refer to Chart 4). However, government receipts in terms of royalties amounted to $25.5 million. This highlights the impact of the war and its economic aftermath on the gold sector.

Chart 4: Gold Production and Exports During (2011- 2023)

Source: Foreign Trade Statistical Digest, CBOS.

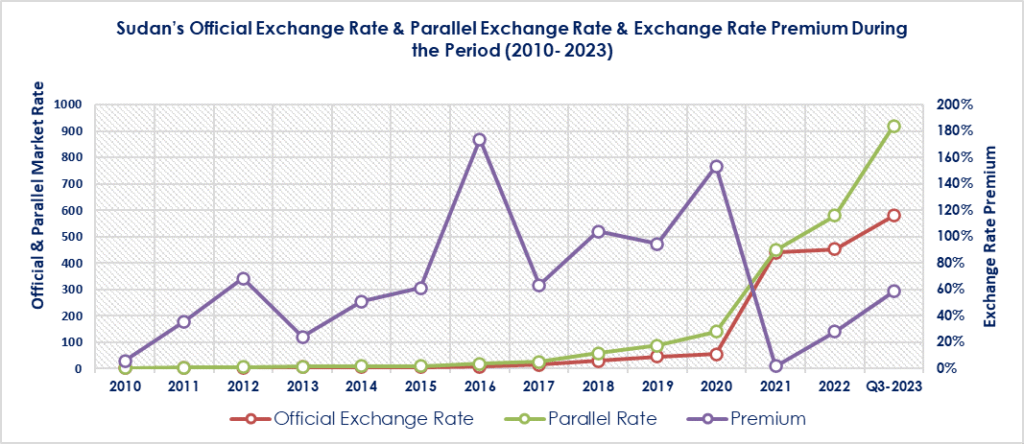

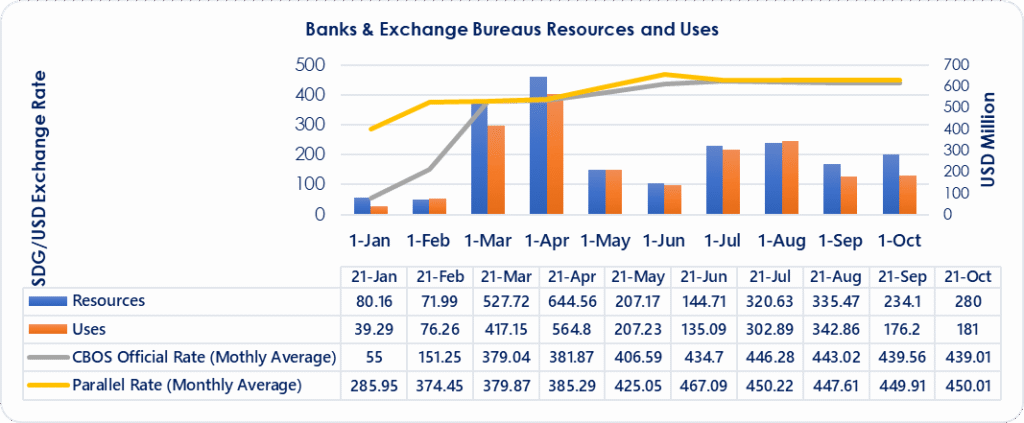

Exchange Rate Update. The CBOS has exhausted its foreign currency reserves, particularly in monetary gold. The SDG's value against the US dollar has devalued by over 30 percent in the past five months and approximately 70 percent since the coup. Given the evolving political landscape, we expect the SDG to continue devaluing. While the exchange rate remained relatively stable for a time, we've observed a significant decline in the SDG's value following the resumption of import activities. Unfortunately, further devaluation episodes are likely if the war persists.

Chart 5: Exchange Rate Developments During (2010- 2023)

Source: Policies, research, and Statistics Department, CBOS.

One of the major milestones before the 25th October 2021 military coup was the stability of the exchange rate (Chart 6). The steps taken by the former Transitional Government towards a market-determined exchange rate went smoothly. The post-unification exchange rate has been relatively stable. The unification of the official exchange rate in February 2021 had a significant impact on the parallel market exchange rate, especially after the issuance of the CBOS circulars. 12/2021 on the mechanism of interference in the FX market through auctions; and no. 14/2021 on the payment of post-paid import operations through funds assigned from the auctions. These efforts played a key role in the elimination of multiple currency practices and exchange restrictions. These are important for preventing individuals with privilege from using these differences for personal gain.

Chart 6: Exchange Rate Developments after the Unification Measures (Jan- October 2021)

Source: Policies, research, and Statistics Department, CBOS.

Overall, a persistent trade deficit can put pressure on a country's currency. Sudan consistently imports more than it exports, and it requires more foreign currency to pay for these imports. This can lead to depreciation of the domestic currency, making imports more expensive and potentially fueling inflation. Mismanagement of Gold Production in Sudan has played a key role in the presence of a huge informal parallel foreign exchange market. The experience has shown that the supply of foreign currency in the parallel foreign exchange market in Sudan comes from the smuggling of gold exports. Furthermore, in times of disorder, such as during wartime and with loosely guarded borders, illicit financial flows in gold are expected to grow significantly, exerting even greater pressure on the domestic currency.

Chart 7: Trade Balance Developments During (2010- 2023)

Source: Foreign Trade Statistical Digest, CBOS

- Expansionary Fiscal & Monetary Policies

To mitigate the economic damage caused by the war, an expansionary fiscal policy – an increase in government spending - is essential from a macroeconomic standpoint. Such policies play a crucial role in post-war recovery efforts by offering vital support to the most affected sectors of the economy and facilitating the rehabilitation of key public and private institutions. Expansionary fiscal policy can also support government stimulus packages, allowing resources and funds to be targeted at sectors in need of support. This can include providing financial assistance to businesses, investing in infrastructure development, offering incentives for economic growth, addressing the cost-of-living crisis, and job creation. Such measures are aimed at revitalizing the economy and promoting the recovery of affected sectors. More importantly, expansionary fiscal policy can contribute to the rehabilitation of public institutions that may have suffered damage during the war, rebuilding and strengthening these institutions, ensuring their proper functioning and capacity to deliver essential services to the public. Similarly, private institutions can benefit from fiscal support to recover and resume their operations. This assistance can include measures such as tax incentives, access to credit, and support for innovation and entrepreneurship.

In the Monetary policy side. Credit Availability is crucial, as ensuring access to credit for essential sectors like agriculture and basic industries is vital to maintaining stability and essential services during wartime. War often disrupts the economy, leading to increased government spending, which can fuel inflation. Monetary authorities need to strike a balance between providing necessary liquidity and preventing hyperinflation even over the medium term.

In summary, during wartime, monetary policy and domestic credit management become complex tasks that require a delicate balance between supporting the economy, maintaining price stability, and ensuring financial stability. Coordination between various government agencies and transparency in policymaking are essential in navigating these challenges.

- Banking Sector

Sudan’s war has caused extraordinary pressure on the stability of the Sudanese banking system. All bank headquarters have been closed since the outbreak of the war on April 15, 2023, with some of them being destroyed and looted, including various bank branches.

The sector’s profitability is expected to be hit hard as a result of financial losses driven by expected losses on credit extended. Moreover, the repercussions of an ongoing war are on the resilience and soundness of the banking sector. In terms of the functionality of banks following the war, the centralization of banking operations in Khartoum and heavy dependence on headquarters, most of which are now in a war zone, can severely impact the functioning of branches located in other states.

The ongoing conflict in Sudan creates substantial challenges for banking customers, negatively impacting the well-being of individuals and business operations. This situation arises due to the damage caused to central payment systems and the subsequent disruption of banks' operations.

Although the CBOS successfully restored the operation of the Real Time Gross Settlement System (RTGS) “SIRAG system” on September 10, 2023, efforts are ongoing to resume the Electronic Clearing System (ECC). However, challenges persist, especially for customers of approximately 32 banks hosted in the national switch managed by the Electronic Banking Services Company (EBS). These customers were unable to access their accounts and utilize their funds. The situation worsened as the exchange rate deteriorated, causing them to lose nearly half the value of their account balances. Even banks with private switches, such as the Bank of Khartoum, Faisal Islamic Bank, Omdurman National Bank, Al-Baraka Islamic Bank, and Al-Salam Bank, encountered difficulties in providing services. Despite these challenges, they managed to offer essential services through banking applications, enabling money transfers and the purchase of necessary goods and services.

Lending activity by banks is expected to shrink further as banks are less able to engage in financial intermediation activities and provide necessary credit and financing to targeted economic sectors compared to before the war. Banks face limitations in mobilizing deposits, as well as receiving support from the CBOS, and regional banks are not expected to make credit available. Banks will adopt more credit rationing pertaining to the credit extension to avoid the risk of default. Even before the war, financial intermediation in Sudan remained below the Sub-Saharan Africa (SSA) average. Financing to enterprises and households stood at 9.5 percent of GDP as of end 2021 (8.7 percent of GDP in June 2020, 11.6 percent in 2019, 9.7 percent in 2018) against the SSA average of 18.8 percent.

- Humanitarian Assistance: Mobile Payments help People during and post-war times

As of December 2024, Sudan is confronting an escalating food security crisis, exacerbated by ongoing conflict and displacement. Recent analyses from the Integrated Food Security Phase Classification (IPC) reveal that over half of Sudan's population, approximately 24.6 million people, are experiencing high levels of acute food insecurity (IPC Phase 3 or above) between December 2024 and May 2025. This marks an increase of 3.5 million people compared to earlier projections.

Alarmingly, famine conditions (IPC Phase 5) have been confirmed in five areas. Projections indicate that five additional areas could face famine by May 2025 if the current situation persists.

The conflict, which erupted in April 2023, has severely disrupted agricultural activities, leading to the destruction of crops and critical infrastructure. This has resulted in a significant decline in food production and availability. The Food and Agriculture Organization (FAO) has issued urgent calls for action to address the widening famine and prevent further deterioration of the food security situation.

Given this dire situation, civil society organizations and UNHCR have jointly appealed for $1 bn to provide essential aid. However, our estimates indicate that humanitarian needs may reach $5 bn.

The practical challenge of quickly getting financial support into the hands of the Sudanese. Accordingly, it's vital to streamline the creation of a platform that facilitates cash transfers to the most vulnerable among the MNOs and Sudanese Banks.

Also, Alex De Waal has stated recently in his Article at the FT Newspaper, “The crisis in Sudan calls for a new model of humanitarian aid,” On July 6, 2023. The most efficient and effective modality for humanitarian assistance to Sudan would take the form of cash direct to citizens. This can be done through expanding the existing, limited mobile money financial system. Such a system would also facilitate diaspora remittances, which are likely to have a bigger impact than humanitarian aid and would enable the business community to operate. Setting up such a system could draw on expertise available in Kenya and Somalia.

Cash is revolutionizing the way that humanitarian aid is being delivered. That is why we

proposed earlier to the CBOS that aid distribution be handled by Mobile Network Operators (MNOs) in collaboration with CBOS, based on beneficiary statistics. MNOs would then use their Mobile Payments (MP) systems to transfer aid to beneficiary accounts (Store Value Accounts). This would allow them to manage their accounts through MNOs' agents or use the funds for transactions with merchants in various regions.

Mobile Payments (MP) is an effective option to deliver cash transfers, given that the use of mobile phones in Sudan is very high. According to data from GSMA, as of the beginning of 2022, there were 35.76 million people with cellular mobile connections. MP can therefore help the rural and remote population gain access to gov transfer programs without traveling long distances, or even having a bank account. Sudan has one of the lowest levels of financial inclusion in SSA, with only 15.3 percent of adults having a financial account, with women and the poor particularly underserved.

In most cases, effectively delivering income support to the vulnerable most requires a reliable national ID system that is connected to socioeconomic data. The absence of such a system is causing growing difficulties in accurately targeting eligible beneficiaries, especially for programs like the Sudan Family Support Program (SFSP) “Thamarat” during the transitional period.

To establish robust safety nets using MP during wartime, it's essential to relax regulatory constraints imposed by the CBOS. In 2020, the CBOS shifted from a centralized to a decentralized MP model following the issuance of licensing requirements for payment companies. These changes enabled MNOs to license their payment operators, along with smaller payment firms and Fintech companies. A swift response in reducing restrictions would be highly beneficial for MP platforms, opening opportunities for SMEs and startups to engage in digital financial services.

It’s crucial also to avail interoperability services between MP systems within the country. This enables efficient and effective transfers, purchases, and sales for beneficiaries with access to merchants in these MP systems. However, the referred solution requires the resumption of the operations of Electronic Banking Services (EBS) as a technical arm of the CBOS.

It's worth noting that the EBS buildings were destroyed during the war, resulting in the disruption of all centralized and decentralized payment systems. Most significantly, the national switch, which hosted approximately 32 banks, was also interrupted. As a result, customers of these banks have been unable to access their accounts for withdrawals, either through the banks' apps or other channels. Currently, only five banks with private switches are operational, with the Bank of Khartoum being among the prominent ones.

Despite the current challenges, the CBOS and the EBS teams are working diligently to restore full functionality to all key systems, especially the centralized and systematic ones. The RTGS (Sirag) System has been operational since Sep 10, 2023, and the next step will undoubtedly be the Electronic Clearing Cheques (ECC).

Regarding the MP system, I believe the situation may be a bit complex even with a fully functioning EBS. However, we need to shift our old mindset and engage in high-focus policy discussions with better coordination between CBOS, EBS, and MNOs to facilitate interoperability.

In addition to a technical solution, we believe that “Tackling the difficulties by Building donor-recipient coordination following the outbreak of April 15th, 2023, War in Sudan” is of utmost importance. One of the most promising aspects of improved interaction at the country level is the creation of governance mechanisms that results in greater dialogue and coordination between donors and recipients.

Similarly, Aid would be better coordinated, increasingly aligned with Sudan priorities, and development results would be measured. Moreover, addressing continued inefficiencies in the governance system. We have seen some cross-country experience in this respect; Tanzania has a well-developed framework for mutual accountability, which relies on the work of an independent monitoring group that conducts biennial reviews of both donor and government progress against their various commitments, making both donors and recipients answerable for their promises.

Therefore, improving the effectiveness of aid and development assistance aims to improve the quality of aid and achieve greater developmental impact in Sudan.

Currently, Sudan needs a comprehensive roadmap to help the Sudanese bounce back. Enhance social safety nets by targeting government support for vulnerable groups and leveraging digital technologies to help Sudanese people rebound from the cost-of-living crisis. Promoting the use of mobile money to deliver aid for the neediest.

Rehabilitates the banking system: exploring options to decentralize banking system operations. Moreover, building Disaster Recovery (DR) locations allows banks to function even if the main site is not functioning.

In the post-war era, a political solution is imperative to rescue Sudan's economy. To mitigate the ongoing economic devastation and tackle the cost-of-living crisis, it is crucial to formulate a comprehensive economic recovery plan. Moreover, this plan should emphasize financial sovereignty and civilian oversight of the economy, as these elements are essential prerequisites for a democratic Sudan. A successful transition towards a democracy grounded in good governance and transparency must prioritize economic stability, peaceful coexistence, and equitable resource distribution among all Sudanese citizens.

Post-war recovery measures and reforms should align with the reform agenda outlined in Sudan's IMF Strategy for Fragile and Conflict-Affected States (FCS). This strategy provides a framework to address the unique challenges faced by countries emerging from conflict and fragility. Implementing these reforms can help stabilize the economy, promote good governance, and pave the way for sustainable development in post-war Sudan.

Finally, but of utmost importance, enhancing the Political Economy and Management of Natural Resources is crucial. This need becomes even more crucial given the substantial influence of illicit gold trade and financial flows on Sudan's democratic transition. Effectively addressing these challenges is an urgent necessity.

Sources

- Ibrahim Elbadawi, An “Economistic” perspective on the fate of Sudan between two scenarios; U.S. Institute of Peace Seminar, Washington, DC, July 2023.

- Alex De Waal; Sudan: Prospects for Averting State Collapse, 23 May 2023.

- Food & Agriculture Organization (FAO) reports on Sudan during wartime.

- Sudan Transparency & Policy Tracker (STPT) July 2023. The Banking System During and After the War: Challenges & Policy Recommendations

- Ministry of Finance & Economic Planning, General State’s Government Budget 2023.

- International Monetary Fund (IMF) March 2022. IMF Policy Paper on IMF Strategy for Fragile and Conflict-Affected States (FCS).

- International Monetary Fund (IMF) 2019 Sudan: Article IV Consultation. IMF Country Report No.20/72, IMF, Washington D.C., March 2020.

- International Monetary Fund (IMF) 2016 Sudan: Article IV Consultation. IMF Country Report No.16/324, IMF, Washington D.C., July 2016

- Central Bank of Sudan (CBOS): Annual reports 2010- 2021, Foreign Trade Statistical Digest 2011- Q4 2022. Financial & Economic Review.